Forever Idaho Funds

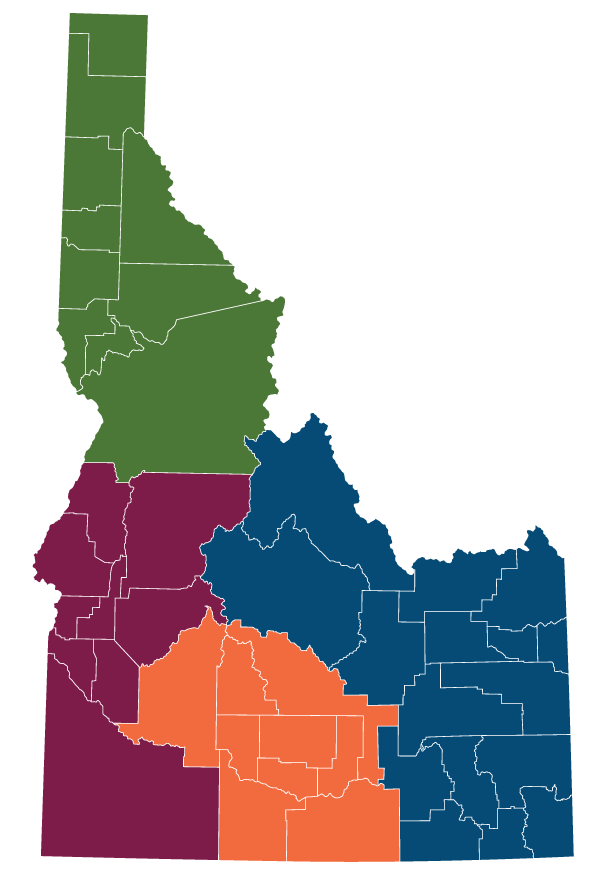

Donors choose to support ICF’s statewide initiatives, a region of Idaho (East, North, South Central or Southwest) or a particular cause. Your gift is combined with others for maximum charitable impact.

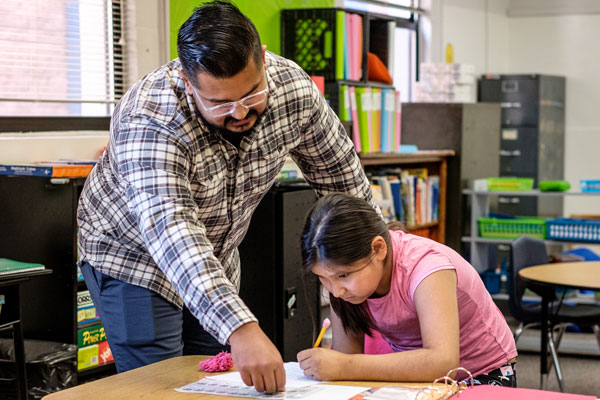

Advocates Against Family Violence

Advocates Against Family Violence