Kris Kamann, CAP®

Senior Philanthropic Advisor

(208) 342-3535 x14

Being an Idahoan means more than living in Idaho—it's about actively investing in our communities. Since 1988, community-minded Idahoans have invested in Idaho through The Idaho Community Foundation. When you give through us, you're not just donating; you're affirming the Idaho way of community-minded living and lasting impact.

Let's do good together.

At The Idaho Community Foundation, we partner with you to create a fund that supports the Idaho communities and causes you care about most. Our funds offer:

Start your fund today and make a meaningful difference!

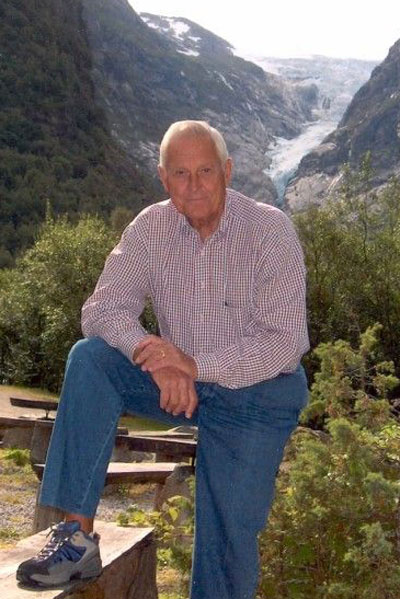

Kris Kamann, CAP®

Senior Philanthropic Advisor

(208) 342-3535 x14

Rich Ballou, CFRE

Philanthropic Advisor, East Idaho

(208) 342-3535 x22

Clark Hyvonen

Philanthropic Advisor, South Central & Southwest Idaho

(208) 342-3535 x28

Bill Pfinsgraff

Philanthropic Advisor, North Idaho

(208) 342-3535 x23

The Idaho Community Foundation offers several different types of funds, each designed to meet the needs of the individuals, families, nonprofits and companies that create them.

Most funds can be endowed or non-endowed. Endowed funds are invested to last in perpetuity and distribute a small percentage of the balance every year. Non-endowed funds are invested to be fully spent within one to seven years.

You select one or more specific charities; ICF makes grant distributions to the charities annually. To learn more and view a list of existing Designated Funds, click here

You select charities every year; can be the same of different year to year. Learn more about Donor Advised Endowed Funds here. Learn more about Non-Endowed Donor Advised Funds here.

Local residents join together to create a fund that supports the community they love. Learn more about ICF Community Funds here.

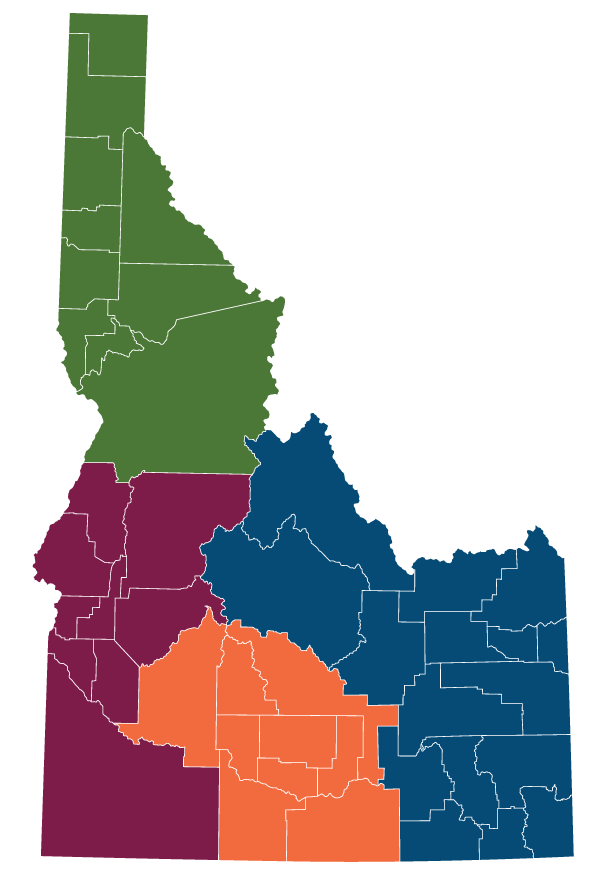

Your donation will be pooled with others for maximum charitable impact. You choose to support a region of Idaho (East, North, South Central or Southwest) or a particular cause. You can also support ICF’s statewide initiatives. Learn more and view the Forever Idaho funds in your region here.

Established by a nonprofit to support their mission. Learn more about Agency Funds here.

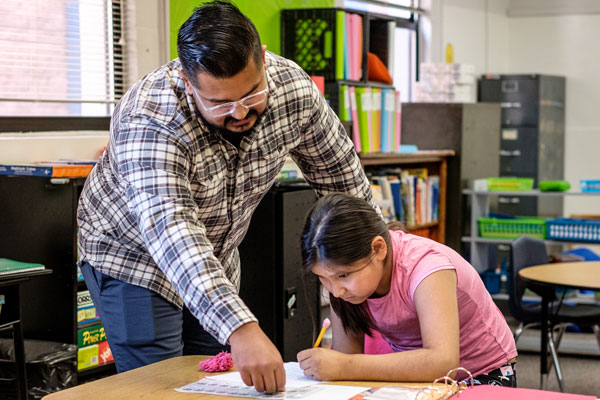

Customize a scholarship for graduates of a certain school, for studies in a specific field or programs at a particular education institution. Learn more about ICF Scholarship Funds here.

ICF acts as a fiscal sponsor for a charitable project, handling the administration and management of funds; distributions are made to complete the project. Learn more about Special Project Funds here.

1. Define your charitable goals

2. Work with our local experts to determine your giving strategy

3. Choose a fund type, timing and name that aligns with your charitable goals

4. Decide what assets to give

5. Finalize the agreement

6. Watch the good grow in Idaho

A gift of cash, check or credit card is the easiest way to create a new charitable giving fund or add to an existing one. Donations by check should be made payable to the Idaho Community Foundation, with a reference to the fund into which they should be deposited, and mailed directly to our main office: Idaho Community Foundation 210 W State Street Boise, ID 83702 Click to make an online donation to an existing ICF fund

Many gifts of appreciated stocks, bonds and mutual funds result in a charitable deduction for the full market value of the donated asset (even if you bought it for less) and minimize capital gains taxes.

for transfer information.

Donating the closely held stock of your business to the community foundation can offer you a charitable deduction for the appraised fair market value and potential saving of capital gains tax.

Potential gifts of privately held stock are carefully evaluated before acceptance.

for more information.

Gifts of real estate often allow you to make a substantial contribution while receiving valuable income tax advantages.

Property will be carefully evaluated before acceptance. Typically, the property must be readily marketable and free of environmental problems.

for more information.

Establish your fund with personal or business property, such as art collections, jewelry, automobiles, business assets and more

Property will be carefully evaluated before acceptance. Typically, the property must be readily marketable and free of environmental problems.

for more information.

Close the foundation and transfer all assets to an Idaho Community Foundation charitable giving fund or provide annual grants to an ICF fund.

An ICF charitable giving fund relieves you and other board members of the complexities and costs associated with running a private foundation. We have several different fund options that may allow you to accomplish the charitable goals of your foundation and continue recommending annual beneficiaries.

Another option: If you’re not quite ready to terminate your private foundation, or would like to do so in incremental steps, you can make grants to ICF to create your own named fund or support an existing one. Granting to an ICF fund may help your private foundation meet the required minimum payout, and still allow your board to have advisory privileges.

for more information.

Click here (pdf) to see a comparison between a private foundation and an ICF fund.

The Idaho Community Foundation has several options for people who want to include philanthropy in their estate planning. Selecting one of these options makes you eligible to join our Legacy Society.

A bequest can be made through a donor’s will or living trust. It is easy to establish and can be revocable. You can state your bequest as a set amount of cash, securities, or other assets; or as the “residue” or a “percentage of the residue” of the estate. Please see our sample bequest language (pdf).

for more information.

Naming the Idaho Community Foundation as a beneficiary of your insurance policy enables you to create a charitable legacy without using cash and other assets designated for your heirs.

Contact your professional advisor to see if a gift of life insurance is a good option for you.Taxation on retirement plan withdrawals decreases their value for your heirs. Consider providing other assets to heirs and naming the Idaho Community Foundation as the beneficiary of your retirement accounts. You can save taxes and preserve your hard-earned assets for the good of your community.

To name the Idaho Community Foundation as the beneficiary of your retirement plan, contact the plan administrator for the IRA or tax-deferred retirement.With a charitable gift annuity, you receive a fixed stream of income for life. Through a simple contract, you agree to make a donation of cash, stocks or other assets to the Idaho Community Foundation. In exchange, we agree to pay one or two individuals (annuitants) fixed quarterly payments for the remainder of their lives. After the passing of the last annuitant, the remaining principal is transferred to a new or existing ICF fund to accomplish your specific charitable goals.

See how a gift like this could work for you.

for more information.

Several types of charitable trusts create valuable options in estate planning by providing tax savings, a significant gift and income for either a charity or family members.

See how a gift like this could work for you.

Contact your professional advisor about establishing a charitable trust.

The Idaho Community Foundation’s Legacy Society recognizes those who will shape Idaho’s future through a planned gift to the Community Foundation. Being a named member of the Legacy Society gives us a chance to thank these generous donors during their lifetimes and may encourage others to join. We also honor anonymous membership.

If you have any question about the Legacy Society, you can email our staff or call (208) 342-3535.

Learn more about the Legacy Society

Being an Idahoan means more than living in Idaho—it's about actively investing in our communities. At The Idaho Community Foundation, we're leading a movement to cultivate a culture of philanthropy across the state. For 35 years, community-minded Idahoans have invested in Idaho through The Idaho Community Foundation. When you give through us, you're not just donating; you're affirming the Idaho way of community-minded living and lasting impact.

Connect with Your Love for Idaho!

We simplify philanthropy. Whether you're making a one-time donation or creating a legacy that lasts generations, our goal is to help you support the Idaho communities you hold dear.

From Idaho, For Idaho

We live here, work here, and have a vested interest in Idaho's future. With deep roots and an intimate understanding of local needs, we are uniquely positioned to make Idaho a better place for all.

Giving through ICF is more than a financial transaction. Our staff have a deep love for Idaho, and we can help you succeed in your philanthropy. Your giving experience through ICF will be rewarding, fun and easy.

A charitable giving fund at ICF allows you to be strategic with your giving. You’ll have opportunities to use ICF’s deep community knowledge to give to the organizations that will meet your philanthropic goals.

A single large gift can be an administrative burden to an organization and distract from their ability to accomplish their programmatic work. Grants from your charitable giving fund can be distributed over time and the recipient will be able to rely on the funding year after year.

ICF completes due diligence before we distribute grants. If the community organization(s) ceases to exist or is not in good standing as a qualified nonprofit, we will share that information with you. For funds created by estate gifts, we will find a replacement(s) doing similar work in the same community. You don’t have the same guarantee when you make a large, direct gift to an organization.

People who create a Donor Advised Funds (DAF) at the community foundation are active and engaged in their community. They come to us because they want to deepen their understanding of community needs and connect with the organizations making an impact.

Giving through ICF is more than a financial transaction. Our staff have a deep love for Idaho, and we want to help our donors succeed in their philanthropy. We make the giving experience rewarding, fun and easy.

An important distinguishing feature of a community foundation is “variance power,” which gives a community foundation the ability to change the charitable purpose of a fund if circumstances have sufficiently changed to make the original restriction inappropriate.

The easiest case for exercising the variance power is when a charity that was the beneficiary of a designated fund goes out of existence. Through its monitoring function, a community foundation can exercise the variance power if it determines that a charity has significantly changed the nature of its operations. It can also exercise the variance power if the purpose becomes obsolete, for example, a trust to fund research to find a cure for polio or cancer after a cure is found.

Variance power is given to community foundations by U.S. Treasury Regulations.

Our Investment Subcommittee and investment consultants are experienced, dedicated professionals who ensure our charitable investments are managed responsibly. Learn more about our financial stewardship.

An ICF fund can be established quickly if you know your charitable goals and which assets you will use to create it.

Yes.

The Idaho Community Foundation has a Confidentiality Policy that states we will not discuss or disclose donor records, donor financial statements or any other information without the authorization of ICF’s President/CEO or the President/CEO’s designee.

Yes, anyone can make new donations at any time of any size. All donations are eligible for a tax deduction.

Any qualified nonprofit public charity, schools and some governmental entities may receive grants.

For Designated and Forever Idaho funds, we will continue to follow the instructions listed in the fund agreement.

For endowed Donor Advised Funds, you may name successor advisors to make grant recommendations and continue your family’s legacy of giving. Or you can convert your Donor Advised Fund to a Designated or Forever Idaho fund upon your passing.

For non-endowed Donor Advised Funds, any remaining fund balance will be distributed according to the instructions you provided when you established the fund.

If your children are 18 or older, you can name them as advisors on your Donor Advised Fund. You can also name them successor advisors.